ETH Price Prediction: Path to $5,000 Amid Technical Consolidation and Institutional Momentum

#ETH

- Technical Breakout Potential: ETH must clear the $4,431 resistance (20-day MA) to initiate upward momentum toward $5,000

- Institutional Catalyst Strength: Fidelity's tokenized fund and Upbit's Layer 2 deployment provide fundamental support for price appreciation

- Market Sentiment Alignment: Whale accumulation and increased staking activity indicate smart money confidence in ETH's medium-term prospects

ETH Price Prediction

Technical Analysis: ETH Faces Key Resistance at 20-Day Moving Average

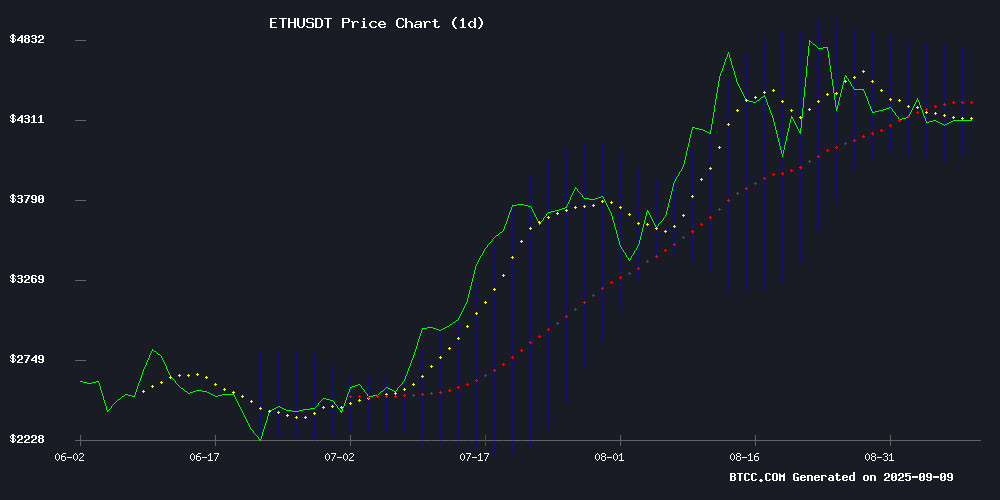

ETH is currently trading at $4,314.60, positioned below its 20-day moving average of $4,431.66, indicating potential short-term bearish pressure. The MACD reading of 168.74 versus its signal line at 65.77 shows bullish momentum remains intact, though the convergence suggests possible consolidation. Bollinger Bands reveal ETH trading NEAR the middle band with upper resistance at $4,785.79 and lower support at $4,077.52, creating a defined trading range.

According to BTCC financial analyst Michael, 'The technical setup suggests ETH needs to reclaim the $4,450 level to target higher resistance zones. Failure to hold above $4,077 could trigger a test of lower support levels.'

Market Sentiment: Institutional Interest and Whale Activity Support Bullish Outlook

Recent developments show significant institutional adoption with Fidelity launching a tokenized fund on ethereum and Upbit deploying a high-speed Layer 2 solution, indicating growing enterprise confidence. Whale accumulation patterns and increased staking activity suggest smart money positioning for potential upward movement.

BTCC financial analyst Michael notes, 'The combination of institutional adoption and fundamental network improvements creates a constructive backdrop for ETH. However, traders should monitor the $4,300 resistance level closely as breaking above could trigger the next leg higher.'

Factors Influencing ETH's Price

Ethereum Whale Activity and Staking Surge Signal Potential Next Price Rally

Ethereum whales are making significant moves, with one investor staking $86 million worth of ETH, signaling strong confidence in the asset's long-term potential. This surge in staking activity coincides with technical indicators suggesting ETH is oversold on the 3-day chart, hinting at a possible rebound.

The derivatives market is also heating up, with open interest and trading volume gaining momentum. Despite a slight 1.03% dip in the past 24 hours to $4,285.10, Ethereum's fundamentals appear robust. Analysts note ETH remains one of the few major cryptocurrencies yet to experience a significant rally this cycle.

Market observers point to growing institutional interest as the key driver behind Ethereum's recent activity. The network's staking yield and upcoming protocol upgrades continue to attract sophisticated investors.

Ethereum Breakout Near $4,450 as Institutional Interest Grows

Ethereum's price hovers at a critical juncture, with traders weighing technical signals against key support and resistance levels. BitMine Immersion Technologies has amplified its ETH holdings, injecting fresh momentum into the market. The move underscores growing institutional confidence in Ethereum's long-term potential.

Technical indicators paint a mixed picture. Ethereum trades below its short-term exponential moving averages, signaling consolidation. The MACD remains in negative territory, while the RSI nears neutral—reflecting market indecision. A breakdown could test supports at $4,075, $3,747, or $3,628. Conversely, a breakout above $4,450 may pave the way toward $4,749 and $4,832 resistance levels.

Ethereum Battles Resistance at $4,300 Amid Mixed Market Signals

Ethereum faces a critical test at the $4,300 resistance level as institutional moves and technical factors collide. The second-largest cryptocurrency dipped 0.32% to $4,316, reflecting market hesitation after BlackRock's reported sell-off and BitMine's counterbalancing accumulation.

Market technicians note this price zone has become a decisive battleground. A breakout could signal renewed bullish momentum, while rejection may trigger short-term consolidation. Historical patterns suggest Ethereum's volatility often precedes major moves—the 2017 and 2020 rallies saw ETH deliver exponential returns when fundamentals aligned with market sentiment.

Long-term projections remain optimistic, with some analysts maintaining $10,000 price targets based on network adoption trends. The current standoff exemplifies cryptocurrency's dichotomous nature—where institutional activity and retail sentiment intersect at precise technical levels.

South Korea’s Upbit Launches High-Speed Ethereum Layer 2 Blockchain

Upbit, South Korea's dominant cryptocurrency exchange, has unveiled Giwa, its proprietary Ethereum Layer 2 network, at the Upbit D Conference 2025. The move positions Upbit alongside global heavyweights like Coinbase and Binance in the race to scale Ethereum's infrastructure.

Giwa—short for Global Infrastructure for Web3 Access—leverages Optimistic Rollup technology built on Optimism's OP Stack. Early tests on the Giwa Sepolia testnet demonstrate robust performance, with over 4 million blocks processed. The network promises near-instant transactions through one-second block times while maintaining Ethereum-level security.

With complete developer tooling including EVM compatibility and a live block explorer, Upbit aims to seamlessly migrate existing Ethereum smart contracts. The exchange's 73% market share in South Korea and $2.5 billion daily trading volume provide a ready adoption pipeline for the new network.

SharpLink Gaming Initiates $1.5 Billion Stock Buyback, Leveraging Ethereum Treasury Strength

SharpLink Gaming has commenced its $1.5 billion share repurchase program, acquiring 930,000 SBET shares at an average price of $15.98, totaling $15 million. The move follows August's authorization and marks the firm's first buyback under the initiative.

SBET shares rallied 4.4% on the news, though remain down 31% monthly. Co-CEO Joseph Chalom emphasized capital discipline, citing the company's debt-free position and income-generating ETH treasury as strategic advantages for value creation.

The Minnesota-based firm holds the second-largest public Ethereum treasury with 837,230 ETH ($3.6 billion), positioning its buyback as a contrarian bet against perceived market undervaluation.

Barter Acquires Copium Capital's Solver Codebase to Strengthen CoW Swap Dominance

Barter, Ethereum's second-largest routing engine and leading solver on CoW Swap, has acquired the solver codebase of rival Copium Capital. The move consolidates two of CoW Swap's most effective strategies—Copium's expertise in RFQ and market maker liquidity, and Barter's dominance in AMM routing. CEO Nikita Ovchinnik sees this as the missing piece to push Barter beyond 50% market share on CoW Swap.

With Ethereum's Pectra upgrade and the rise of gas-optimized AMMs like Euler Swap, Fluid, and Ekubo, RFQ liquidity has waned. Yet Barter believes integrating Copium's capabilities will cement its leadership. CoW Swap's mechanism inherently selects the best price per order, making solver comparisons less relevant—winners are determined by real-time quote superiority.

Barter has already processed $18 billion in volume, averaging $900 million weekly. The integration of Copium's code is expected to further streamline execution efficiency.

OpenSea Launches $1M NFT Reserve With CryptoPunk Acquisition

OpenSea, the dominant NFT marketplace, has established a $1 million reserve fund to acquire and preserve culturally significant digital art. The initiative debuted with the purchase of CryptoPunk #5273 for 65 ETH ($283,000), signaling a strategic move to position NFTs as historical artifacts.

The reserve will target works that have shaped the NFT ecosystem through creative, social, or technological influence. CryptoPunks—the 2017 Ethereum profile picture collection with a $2.1 billion market cap—embodies the type of culturally impactful project OpenSea seeks to preserve.

This institutional-grade curation comes amid slowing NFT sales volume in September. OpenSea's initiative suggests long-term confidence in blue-chip collections despite short-term market fluctuations.

Ethereum Core Developers Face Significant Pay Gap Despite Critical Role

Ethereum's most vital developers are severely underpaid compared to industry standards, according to a new compensation report from the Protocol Guild. The median core developer earns $140,000 in fiat compensation—far below the $300,000 median external offer, a 114% gap. Protocol Guild distributions, delivered via onchain vesting, add $67,121 at the median, but total compensation still lags behind market rates.

Only 37% of surveyed contributors receive equity or token grants from employers, leaving Protocol Guild as the primary source of long-term, ecosystem-aligned incentives. Nearly 40% of developers reported receiving external offers—often from L2s or competing L1s—with token or equity components, highlighting the retention challenges Ethereum faces.

Fidelity Launches FDIT Tokenized Fund on Ethereum

Fidelity has introduced FDIT, a tokenized share class of its Treasury fund, built on the Ethereum blockchain. This innovation brings U.S. Treasuries on-chain with 24/7 transferability and institutional-grade custody. The fund focuses on short-duration Treasuries and cash equivalents, positioning itself as a compliant, yield-driven real-world asset (RWA) product.

ONDO Finance emerges as the largest investor, utilizing FDIT as a reserve asset for OUSG to bolster liquidity and settlement efficiency. Fidelity's move aligns it with major asset managers venturing into tokenized funds, potentially accelerating institutional adoption of on-chain treasury solutions.

SharpLink Gaming Repurchases $15M in Shares Amid Ether Holdings Valuation Discrepancy

SharpLink Gaming (SBET), a Nasdaq-listed company with significant ether (ETH) holdings, has repurchased $15 million worth of its shares, citing undervaluation relative to its $3.6 billion ETH treasury. The Minneapolis-based firm bought back approximately 939,000 shares at an average price of $15.98, reinforcing confidence in its long-term strategy.

The stock rose 3.6% in pre-market trading following the announcement, mirroring a 1% uptick in ETH's price. SharpLink's ETH holdings are nearly entirely staked, generating a steady income stream. Currently trading at a 0.87 multiple of net asset value, the company faces constraints in raising capital through share sales for additional ETH acquisitions.

Executives emphasized avoiding share dilution below NAV to preserve ETH-per-share metrics—a critical benchmark for the firm. The move comes as digital asset treasury firms face pressure amid cooling crypto markets.

SharpLink Launches $1.5B Share Buyback

SharpLink has initiated a $1.5 billion stock repurchase program, acquiring approximately 1 million SBET shares in a move aimed at enhancing shareholder value. The company asserts its stock is undervalued and anticipates the buybacks will be accretive to earnings.

Management highlights a robust ETH-focused balance sheet, with future repurchases contingent on market conditions and liquidity. Capital allocation remains disciplined, prioritizing long-term growth and investor returns.

Will ETH Price Hit 5000?

Based on current technical indicators and market developments, ETH reaching $5,000 remains plausible but requires overcoming key resistance levels. The price must first break above the 20-day MA at $4,431, then challenge the Bollinger upper band at $4,785.

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $4,314.60 | Immediate support/resistance battle |

| 20-Day MA | $4,431.66 | Critical resistance to overcome |

| Bollinger Upper | $4,785.79 | Next major resistance zone |

| Target | $5,000.00 | 18.5% upside from current levels |

BTCC financial analyst Michael suggests, 'The combination of strong institutional interest and positive technical momentum could propel ETH toward $5,000, but traders should watch for sustained volume above $4,450 for confirmation.'